Rating and Grading Process

- Credit Rating Agency in India

- Rating and Grading Process

Solicited ratings

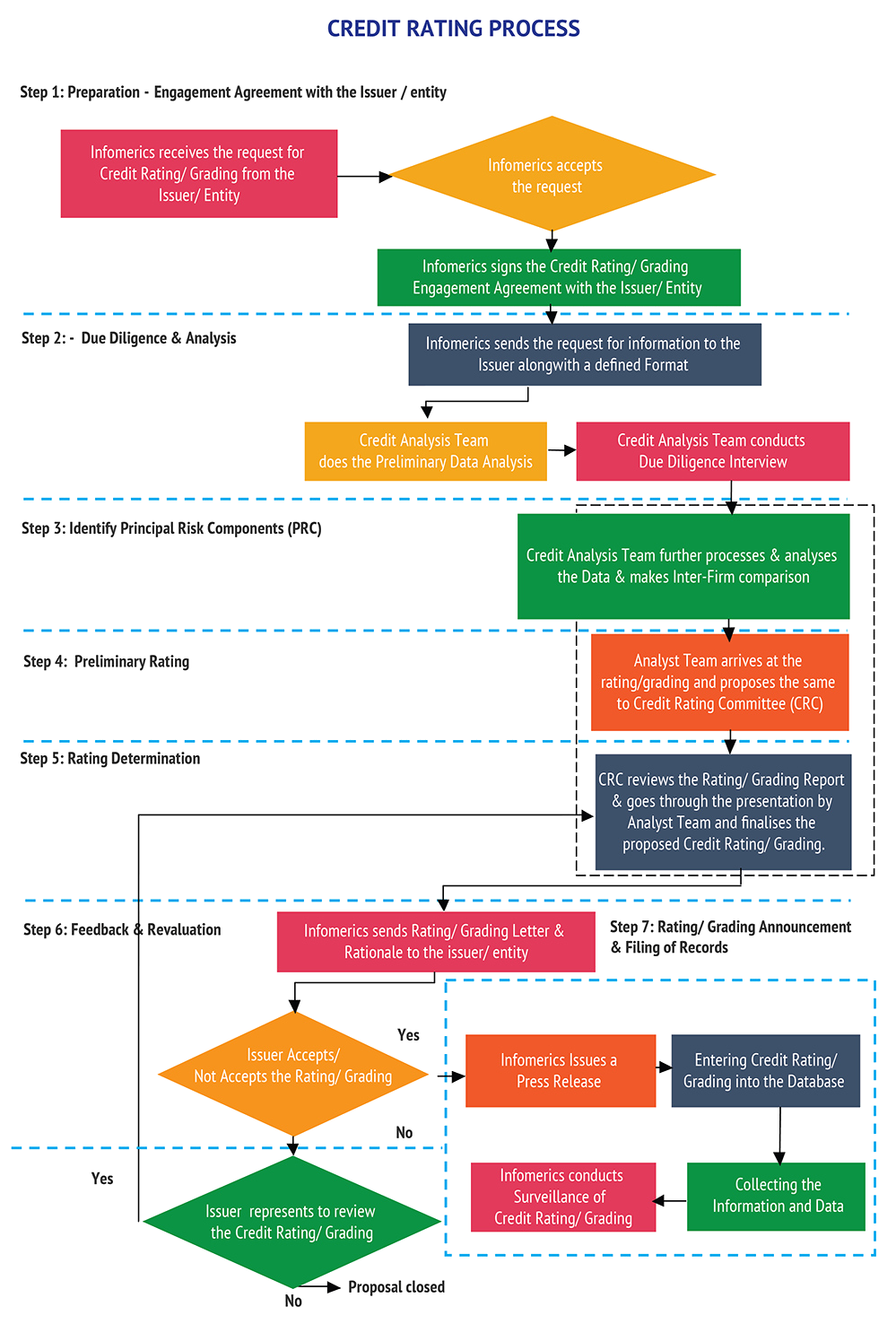

Infomerics Ratings shall undertake only solicited ratings as a policy and shall not take up unsolicited ratings in the normal course.

Written Agreement with the client

SEBI Regulations provide that there shall be written agreement between CRA and the client. Accordingly, Infomerics Ratings shall commence the rating process after receiving Mandate Contract, duly signed by the client and Infomerics Ratings. As per SEBI regulations, the Mandate Contract shall contain the following:

Fees to be charged by CRA;

Client agreeing to providing required information;

Client agreeing to periodic review of rating during tenure of the rated instrument in case of acceptance of rating. Client also agrees to provide true, adequate and timely information for the purpose including No Default Statement on the first date of each month.

Analysts shall not be involved in soliciting business/deciding the commercial terms of the rating assignment. This will be decided by the business development group / CEO.

Rating/Grading Agreement: The Rating Agreement/Mandate Contract signed between Informerics Ratings and the issuer/obligor/client contain the SEBI requirements, wherever applicable. Therefore, no rating exercise (fresh/enhancement) shall be carried out unless the Rating Agreement is executed. Infomerics has a policy of not accepting any mandate from a sector for which its Rating Methodology is not in place.

Assigning the work to Analysts team: Business Development team shall send a copy of the Mandate Contract and hand over the all the preliminary documents to Chief Rating Officer/Rating Head. Chief Rating Officer/Rating Head shall verify the documents and then assign the work to the Analysts team/Analyst which according to him is the most suitable for that assignment.

Submission of information by the client: The Analysts Team/Analyst shall gather information about the issuer of the security being rated (issuer) and the characteristics of the security or obligation being rated (obligation), or, if an entity is being rated itself, information about the entity (obligor). The Analysts Team/Analyst shall then prepare a check list of information requirements and shall send a written communication to the client listing the documents required for the purpose of rating the instrument/facility. In addition to the aforesaid check list, the Analysts Team/Analyst shall ask for other documents/information depending upon the requirement of each case.

Guidelines for Analysts Team/Analyst & Preparation of Report: After thorough evaluation & scrutiny of the information and the documents received and available in the public domain as well as the independent industry evaluation, the Analysts Team/Analyst shall carry out a plant visit in case of a manufacturing company. In case of multi locational plants, the team may decide on visiting one or two plants. In case of a construction company, some of the completed sites and ongoing sites shall be visited.Thereafter, a management meeting shall be carried out with the client to discuss on all the findings during plant visit and detailed study of the papers and also on corporate policies & vision with the key personnel of the rated entity.

Thereafter, a due diligence exercise shall be carried out with the bankers, NCD holders, other lenders and auditors compulsorily. Besides meeting the bankers, NCD holders, other lenders and auditors in person or interacting with them over phone, Infomerics Ratings tries to obtain the required information from them in writing to the extent possible. Infomerics Ratings has a policy to obtain Bank Statements for the last one year in respect of the entity being rated, as far as possible.

Thereafter, the draft Rating Report is compiled by the Analysts Team/Analyst.The credit rating report highlights the basis of rating decision. It also highlights the key factors affecting the rating and provide forward looking opinions on these factors. For the purpose of entire exercise, the relevant methodologies developed by Infomerics Ratings for different sectors and the relevant criteria is followed.

After compilation/preparation of the draft Rating Report, as elaborated above, the Analysts Team/Analyst arrivesat the long-term/medium-term rating based on the credit rating model developed by Infomerics Ratings for certain sectors/segments and the short-term rating is mapped, if need be. Thereafter, the entire Rating Report is placed before the Rating Committee (RC) with recommendation. All proposals are placed before the RC.The RC takes the final decision on assignment of rating independently after having due deliberation on each proposal.

Post-Rating Assignment Process After rating/grading is assigned, a provisional communication by way of an e-mail is made to the rated entity with a request to accept the rating so communicated as per the prescribed format within a maximum period of five days from the date of communication. Where the client does not have email address, such information is communicated on a plain paper through post. This communication is usually made within one working day from the date of the RC Meeting. Before acceptance, the rated entity is also sent the Key Rating Issues, on request, either through e-mail or on a plain paper through post, as the case may be.

If the rating is accepted, Final Rating Letter and Rating Rationale is issued to the rated entity. The Rating Release (as per the SEBI prescribed format) is uploaded in Infomerics’ website within two days of acceptance. The Rating Release is also sent to the stock exchanges and press. If the rating is not accepted, the unaccepted rating is uploaded in Infomerics’ website as per SEBI Regulation. The detailed rating release in case of unaccepted ratings may be shared with regulators or a court of law, upon specific request to provide such information.

In case the rated entity applies for review of the rating, the same is required to be made within the aforesaid maximum period of five days and the same is considered by Infomerics Rating as per its Policy For Appeal By Issuers uploaded in its website. The decision arrived by the Rating Committee on appeal is communicated to the rated entity promptly.

If the rated entity accepts the rating based on the review, the Analyst proceeds with issuing the Final Rating Letter, Rating Rationale and Rating Release. The company allows only one representation and in case the client does not accept the reviewed rating, the rating assignment is closed.

Rating Disclaimers: Infomerics ratings are based on information provided by the issuer on an ‘as is where is’ basis. Infomerics credit ratings are an opinion on the credit risk of the issue / issuer and not a recommendation to buy, hold or sell securities. Infomerics reserves the right to change or withdraw the credit ratings at any point in time. Infomerics ratings are opinions on financial statements based on information provided by the management and information obtained from sources believed by it to be accurate and reliable. The credit quality ratings are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. We, however, do not guarantee the accuracy, adequacy or completeness of any information, which we accepted and presumed to be free from misstatement, whether due to error or fraud. We are not responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by us have paid a credit rating fee, based on the amount and type of bank facilities/instruments. In case of partnership/proprietary concerns/Association of Persons (AOPs), the rating assigned by Infomerics is based on the capital deployed by the partners/proprietor/ AOPs and the financial strength of the firm at present. The rating may undergo change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor/ AOPs in addition to the financial performance and other relevant factors.